Comparison of Top Accounting Software for Accurate Bookkeeping Software Use

Choosing the right accounting tool can feel overwhelming, especially when every platform promises accuracy, automation, and ease of use. This detailed comparison of top accounting software is designed to help small business owners, freelancers, and growing companies understand their real options. Instead of marketing claims, we’ll focus on how different tools actually perform in day-to-day bookkeeping, reporting, and financial management.

- Why Choosing the Right Accounting Software Matters

- Key Factors Used in This Comparison

- Quick Overview: Top Accounting Software Options

- Detailed Comparison of Top Accounting Software

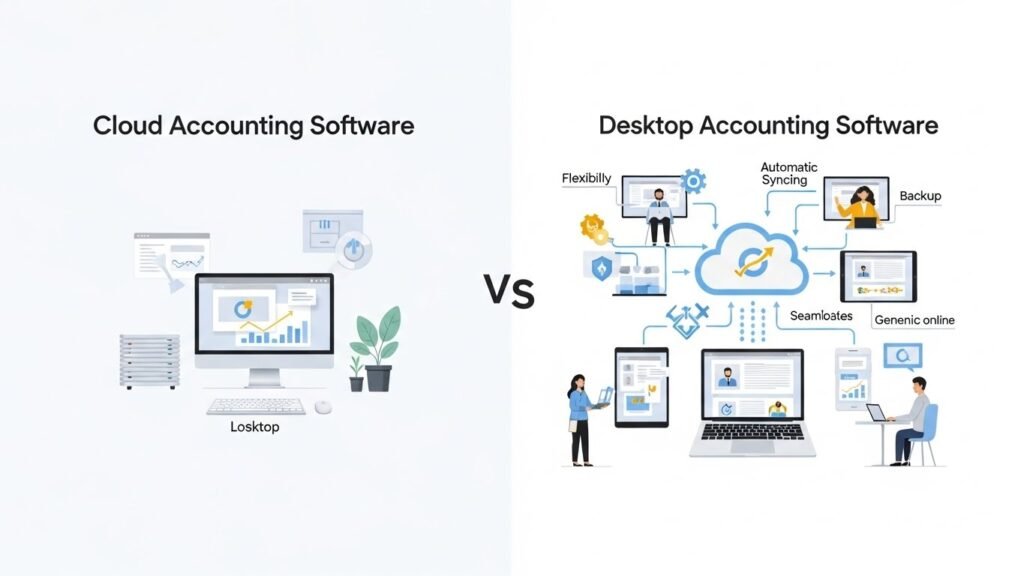

- Cloud Accounting Software vs Desktop Accounting

- How to Choose the Right Software for Accurate Bookkeeping

- Common Mistakes to Avoid When Choosing Accounting Software

- Frequently Asked Questions

Whether you’re looking for reliable bookkeeping software, scalable cloud accounting software, or flexible accounting software for sma, this guide breaks everything down clearly and practically—no technical jargon, no fluff.

Why Choosing the Right Accounting Software Matters

Accounting software isn’t just about recording numbers—it’s a structured system for managing, analyzing, and reporting financial data that supports informed business decisions, as explained in this accounting software definition.

It directly affects how clearly you understand your business, how confidently you make decisions, and how prepared you are for taxes or audits.

The right software helps you:

- Track income and expenses accurately

- Maintain clean, audit-ready records

- Save time through automation

- Access financial data from anywhere

- Scale your processes as your business grows

On the other hand, choosing the wrong tool can lead to confusion, errors, and wasted hours trying to fix reports that never quite add up.

Key Factors Used in This Comparison

Before diving into individual tools, it’s important to understand how this comparison of top accounting software is structured and how different solutions address real-world bookkeeping challenges, as outlined in this accounting software comparison guide.

Each platform is evaluated based on real-world usability rather than promotional features.

1. Ease of Use

Accounting software should simplify your work, not complicate it. Clean dashboards, logical menus, and clear reporting matter—especially for non-accountants.

2. Bookkeeping Accuracy

Accurate transaction recording, reconciliation, and error prevention are essential for trustworthy financial data.

3. Cloud Accessibility

Modern businesses expect secure access anytime, anywhere. Cloud accounting software enables collaboration with accountants and remote teams.

4. Features for Small and Medium Accounts

Good accounting software for sma should balance functionality with simplicity, especially for businesses looking to move beyond spreadsheets without unnecessary complexity, which is why exploring small business accounting options can be helpful.

5. Scalability and Integrations

The software should grow with your business and connect smoothly with banks, payment systems, and other tools.

Quick Overview: Top Accounting Software Options

Here’s a high-level look at some widely used accounting platforms before we explore them in detail:

- QuickBooks Online – Popular all-in-one solution

- Xero – Strong cloud-first accounting platform

- FreshBooks – Simple bookkeeping for service-based businesses

- Zoho Books – Affordable, automation-focused accounting

- Wave Accounting – Basic bookkeeping for very small businesses

Detailed Comparison of Top Accounting Software

QuickBooks Online

QuickBooks Online is one of the most widely recognized names in accounting. It’s often the first option considered by small businesses and accountants alike.

Strengths:

- Comprehensive bookkeeping software features

- Automated bank reconciliation

- Strong reporting and tax preparation tools

- Large ecosystem of integrations

Limitations:

- Pricing increases as features are added

- Interface can feel cluttered for beginners

QuickBooks Online works well for businesses that want structured accounting with room to grow, though some companies eventually explore QuickBooks alternative software as their needs evolve.

Xero

Xero is a cloud accounting software built with collaboration and simplicity in mind. It’s especially popular in Europe and among businesses with remote teams.

Strengths:

- Clean, intuitive user interface

- Unlimited users on all plans

- Strong inventory and invoicing tools

- Excellent cloud accessibility

Limitations:

- Fewer built-in payroll options in some regions

- Advanced reporting may require add-ons

Xero is ideal for businesses that prioritize collaboration and real-time financial visibility.

FreshBooks

FreshBooks focuses on simplicity, making it a favorite among freelancers and service-based businesses.

Strengths:

- Extremely user-friendly design

- Fast invoicing and expense tracking

- Clear income and profit insights

Limitations:

- Limited inventory management

- Not ideal for complex bookkeeping needs

If your business relies heavily on client billing rather than inventory, FreshBooks offers an efficient and stress-free bookkeeping experience.

Zoho Books

Zoho Books is a powerful yet affordable accounting software for sma, especially for businesses already using other Zoho tools.

Strengths:

- High level of automation

- Strong tax compliance features

- Customizable workflows

- Competitive pricing

Limitations:

- Interface may feel complex at first

- Best experience within the Zoho ecosystem

Zoho Books suits growing businesses that want automation without enterprise-level costs.

Wave Accounting

Wave Accounting is often chosen by very small businesses and solo entrepreneurs looking for basic bookkeeping software.

Strengths:

- Free core accounting features

- Simple income and expense tracking

- Easy setup

Limitations:

- Limited scalability

- Basic reporting

- Fewer integrations

Wave works best for businesses with minimal accounting needs and low transaction volume.

Cloud Accounting Software vs Desktop Accounting

One major takeaway from this comparison of top accounting software is the clear shift toward cloud-based solutions.

Cloud accounting software advantages:

- Access from any device

- Automatic updates and backups

- Easier collaboration with accountants

- Better integration with online tools

For most modern small businesses, cloud accounting is no longer optional—it’s the practical standard.

How to Choose the Right Software for Accurate Bookkeeping

There’s no universal “best” accounting software. The right choice depends on how you work.

Ask yourself:

- How complex are my transactions?

- Do I manage inventory or just services?

- Will I work with an external accountant?

- Do I need strong automation or basic tracking?

Accurate bookkeeping comes from software that matches your workflow, not from extra features you never use.

Common Mistakes to Avoid When Choosing Accounting Software

- Choosing based on popularity alone

- Overpaying for unused features

- Ignoring ease of use

- Not considering future growth

A thoughtful selection saves time, reduces errors, and supports long-term financial clarity.

Frequently Asked Questions

What is the most accurate accounting software for small businesses?

Accuracy depends more on correct setup and regular use than brand. Well-configured cloud accounting software like QuickBooks or Xero can deliver excellent accuracy.

Is cloud accounting software safe?

Yes, reputable cloud platforms use strong encryption, secure servers, and regular backups, often making them safer than local desktop systems.

Do I need accounting software if I already use spreadsheets?

Spreadsheets can work initially, but dedicated bookkeeping software reduces errors, saves time, and provides better financial insights as your business grows.

Can accounting software replace an accountant?

Accounting software supports bookkeeping but doesn’t replace professional advice. Many businesses use both together for the best results.

How often should bookkeeping be updated?

Ideally, bookkeeping should be updated weekly or in real time to maintain accurate and reliable financial records.