Making smart real estate decisions depends heavily on understanding the market, and that’s where a comparative market analysis tool becomes invaluable. Whether you are a seasoned agent or a first-time seller, knowing the true value of a property can make or break your deal. In this article, we’ll explore how a comparative market analysis tool helps in performing precise CMA real estate evaluations and why it’s essential for anyone involved in real estate market analysis.

What is a Comparative Market Analysis (CMA)?

A CMA comparative market analysis is a process real estate professionals use to determine a property’s value based on recently sold, similar properties in the same area, as explained in our real estate market trends guide.

Unlike formal appraisals, CMAs provide quick insights for pricing, selling, or buying homes. The goal is to ensure properties are competitively priced and market-ready, giving both sellers and buyers a realistic picture of value.

Why Accuracy Matters in Real Estate Market Analysis

Accurate real estate market analysis is critical, and understanding the fundamentals of a CMA is explained in this Investopedia guide on comparative market analysis.

Overpricing can lead to a property sitting on the market for months, while underpricing may result in financial loss. A CMA real estate evaluation lets agents and property owners understand trends, compare local listings, and make decisions backed by data rather than guesswork.

How a Comparative Market Analysis Tool Improves CMA Real Estate Decisions

A dedicated comparative market analysis tool simplifies the process of creating CMAs and enhances decision-making in several key ways:

1. Streamlined Data Collection

Manually researching comparable properties can be tedious and prone to errors, which is why our top real estate tools 2025 review can help streamline the process.

A CMA tool automatically gathers data from multiple listing services, public records, and recent sales, ensuring your CMA real estate analysis is accurate and up-to-date.

2. Comprehensive Property Comparisons

The tool allows for detailed side-by-side comparisons of property features, neighborhood trends, and price per square foot. This depth of analysis helps agents create precise valuations and strengthens negotiation strategies.

3. Trend Analysis and Market Insights

Beyond simple comparisons, CMA tools provide visual charts and trends, like rising or declining property values in a neighborhood, similar to the insights shared in real estate data visualization techniques.

Understanding these patterns equips sellers and buyers to make informed decisions rather than relying on instinct.

4. Time Efficiency

Generating a CMA manually can take hours. With a comparative market analysis tool, you can produce reports in minutes, freeing up time to focus on client consultations, marketing, and closing deals.

5. Improved Client Communication

Professional, easy-to-read CMA reports increase client trust. Clients can see comparable sales, trends, and suggested price points clearly, making them more confident in your recommendations and decisions.

Key Features to Look for in a CMA Tool

- MLS Integration: Access to live data from multiple listing services.

- Customizable Reports: Tailor reports for buyers, sellers, or internal analysis.

- Neighborhood Analytics: Insights on schools, amenities, and crime rates.

- Visual Data Representations: Graphs and charts for trends and comparisons.

- Mobile Access: Ability to create CMAs on the go from smartphones or tablets.

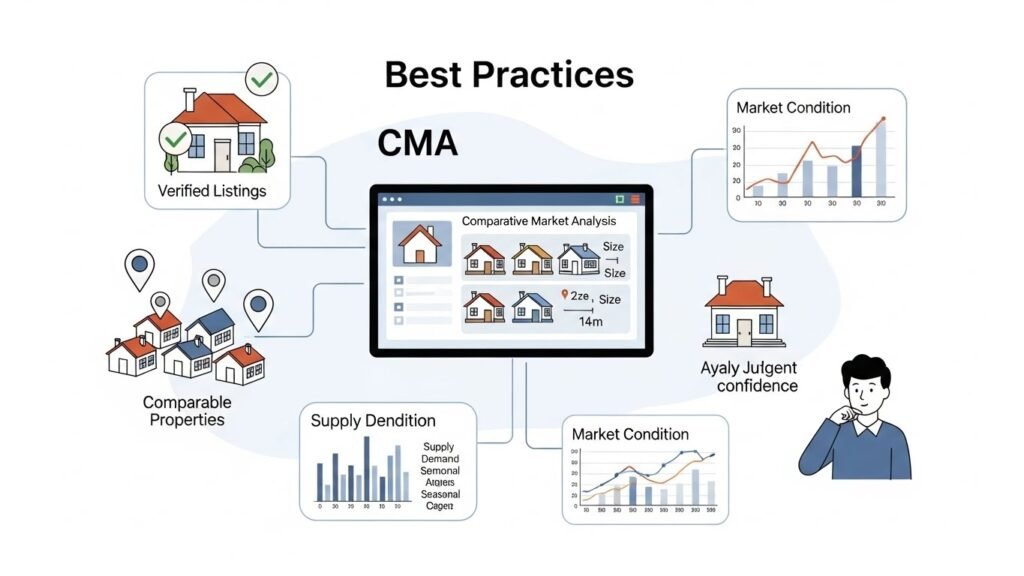

Best Practices for Using a CMA Comparative Market Analysis Tool

- Always verify the data: Even the best tools can have outdated listings.

- Consider multiple comparables: Include properties that are similar in size, location, and condition.

- Factor in market conditions: Supply, demand, and seasonality can impact pricing.

- Use it as a guide, not a rule: CMA tools provide data, but human judgment is essential.

Conclusion

In today’s fast-paced real estate environment, relying solely on intuition can be risky. A comparative market analysis tool gives you an edge, combining data accuracy, trend insights, and efficiency. Whether you are pricing a property, advising clients, or analyzing local markets, this tool ensures your CMA real estate decisions are informed, precise, and confident. Leveraging such technology transforms complex real estate market analysis into actionable insights, helping professionals make smarter, faster decisions.

FAQ

What is the difference between a CMA and an appraisal?

A CMA provides a market-based estimate using recent comparable sales, while an appraisal is a formal valuation by a licensed professional. CMAs are quicker and often used for pricing decisions, while appraisals are legally binding.

Can I use a CMA tool as a first-time homebuyer?

Yes. CMA tools are not limited to agents. First-time buyers can use them to understand market trends, compare similar homes, and negotiate better offers.

How often should a CMA be updated?

It’s best to update CMAs regularly, especially in fast-moving markets. Weekly or monthly updates ensure the data reflects current conditions and pricing trends.

Are CMA tools expensive?

The cost varies. Some real estate platforms offer CMA features included with subscription plans, while standalone tools may have monthly or annual fees. The investment often pays off through more accurate pricing and faster sales.

Do CMA tools replace real estate agents?

No. CMA tools provide data and analysis, but professional expertise is essential for interpretation, negotiation, and guiding clients through the buying or selling process.