Starting your investment journey can feel overwhelming. With so many options available, it’s hard to know which platform is right for you, but our guide to top finance tools for beginners can help simplify your choice.

That’s why finding the best investment apps for beginners is essential. The right app can simplify investing, help you learn the ropes, and even grow your wealth without confusion or stress.

Why Choosing the Right Investment App Matters

Not all investment apps are created equal. Some are designed for experienced traders, while others cater specifically to beginners. Choosing the wrong app can lead to frustration, costly mistakes, or even giving up on investing entirely, which is why understanding investment basics is essential.

A good beginner-friendly app should:

- Offer a simple, intuitive interface

- Provide educational resources to learn the investing basics

- Have low or no fees, especially for small accounts

- Allow access to a variety of investment options

Key Features to Look for in the Best Investing App for Beginners

When searching for the best app for beginner investing, consider the following features:

- Why Choosing the Right Investment App Matters

- Key Features to Look for in the Best Investing App for Beginners

- Top Tips for Choosing the Best Investment App for Beginners: Free or Paid

- Common Mistakes to Avoid as a Beginner Investor

- Popular Options for the Best Investment App for Beginners

- Conclusion

- FAQ

1. User-Friendly Interface

Ease of use is critical for beginners. A clean, intuitive interface helps you navigate investments, track your portfolio, and make decisions confidently without feeling lost.

2. Educational Tools

Look for apps that offer tutorials, guides, or in-app tips, similar to the strategies we cover in how to learn finance for beginners.

These features can help you understand stock markets, ETFs, and other investments while you practice investing in real time.

3. Low or No Fees

Fees can eat into your returns, especially when starting with small investments. Many apps now offer commission-free trading or free investment accounts, making them perfect for beginners.

4. Investment Variety

A good beginner app should provide access to multiple investment types, such as:

- Stocks

- ETFs

- Mutual funds

- Cryptocurrency (optional)

5. Automated Features

Features like robo-advisors or auto-investing can make investing easier for beginners by automatically balancing your portfolio based on your goals and risk tolerance.

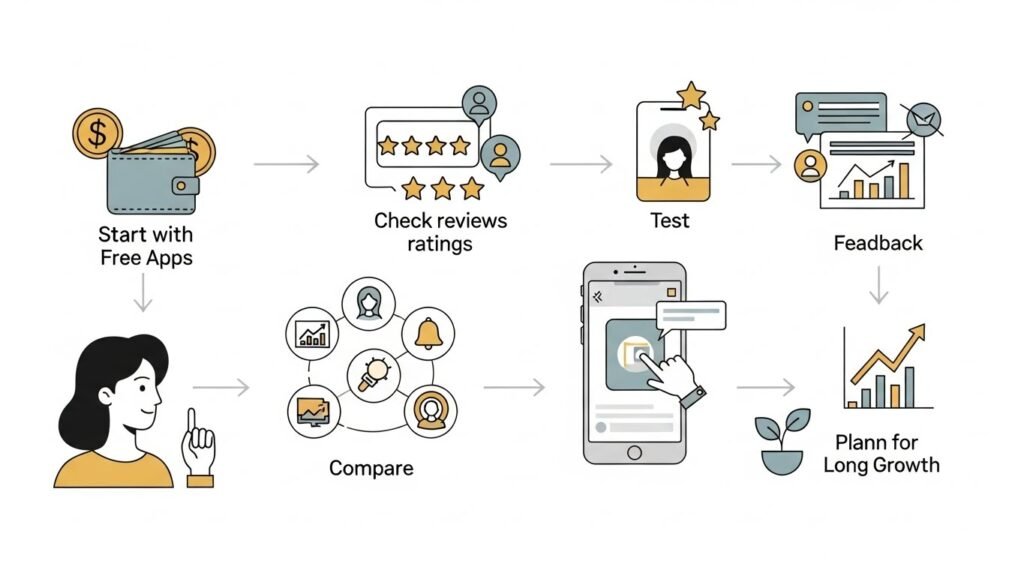

Top Tips for Choosing the Best Investment App for Beginners: Free or Paid

Here are practical tips to narrow down your options and select an app that truly fits your needs:

1. Start With Free Apps

Many beginner-friendly apps offer free accounts. Using a free app first allows you to learn investing without risking money or paying fees.

2. Check Reviews and Ratings

Read what other users say about the app, and compare with insights from our best budgeting apps for startups guide.

Focus on feedback from beginners to understand the learning curve and ease of use.

3. Test the App Yourself

Most apps let you create a demo or practice account. This hands-on approach helps you explore features, track performance, and decide if it feels comfortable.

4. Compare Features

Make a short list of features that matter most to you, such as educational content, automatic investing, or mobile notifications, and see which app meets those needs best.

5. Consider Long-Term Growth

Even as a beginner, choose an app that can grow with you. You might start small, but you’ll want more advanced tools and options as your experience increases.

Common Mistakes to Avoid as a Beginner Investor

Understanding what to avoid is just as important as knowing what to choose. Beginners often make these mistakes:

- Choosing an app based solely on popularity without checking features

- Ignoring fees that slowly reduce returns

- Jumping into complex investments too early

- Not using the educational tools provided by the app

Popular Options for the Best Investment App for Beginners

Some apps are widely recommended for beginners because they combine simplicity, education, and low costs. Here are a few examples:

- Robinhood: Easy-to-use, commission-free, perfect for small investments

- Acorns: Automates small investments, great for learning habits

- Stash: Offers education and fractional investing for beginners

- Fidelity or Charles Schwab: Free accounts with rich resources for learning

Conclusion

Finding the best investment apps for beginners doesn’t have to be confusing. Focus on apps with intuitive design, low fees, educational tools, and features that match your goals. By starting simple and learning gradually, you can build confidence, make smarter investments, and enjoy a smooth journey into the world of investing.

FAQ

What is the best investing app for beginners?

Apps like Robinhood, Acorns, and Stash are great for beginners because they combine simplicity, educational resources, and low or no fees.

Can I start investing with no money?

Yes, some apps allow you to invest very small amounts or use demo accounts. Apps like Acorns round up purchases to invest spare change, making it easy to start.

Are free investment apps safe?

Many free apps are regulated and secure. Look for apps that are registered with financial authorities and offer account protection to ensure safety.

How do I choose the best app for beginner investing?

Focus on simplicity, educational support, low fees, and features that match your goals. Test a few apps to find the one that feels intuitive and comfortable.

Can I grow my investments using a beginner-friendly app?

Yes, these apps allow gradual growth. Start small, learn the market, and as your confidence increases, you can diversify into more advanced investments.