Customer Relationship Management in Banking for Improving Customer Experience with Modern CRM Software

Customer expectations in banking have changed dramatically. People now expect fast service, personalized offers, and smooth digital experiences across mobile apps, websites, and branches. This is where customer relationship management in banking plays a critical role. Modern CRM systems help banks understand customers better, respond faster, and build long-term trust in an increasingly competitive financial world by strengthening overall customer relationship management strategy.

- What Is Customer Relationship Management in Banking?

- Why CRM Is So Important in the Banking Industry

- How Modern CRM Software Improves Customer Experience

- Key Features of Banking CRM Software

- Benefits of CRM Software for Banks

- Role of CRM in Digital Banking Transformation

- Challenges Banks Face When Implementing CRM

- Future of Customer Relationship Management in Banking

- Frequently Asked Questions

In this guide, we’ll explore how customer relationship management works in banking, why it matters so much today, and how modern CRM software is transforming the customer experience for banks of all sizes.

What Is Customer Relationship Management in Banking?

Customer relationship management in banking refers to the strategies, technologies, and processes banks use to manage interactions with customers throughout their entire lifecycle, as defined in the official CRM overview. From opening an account to applying for loans, resolving issues, or receiving personalized financial advice, CRM systems help banks keep every interaction connected and meaningful.

Unlike basic customer databases, banking CRM software combines customer data, transaction history, communication records, and behavior insights into one centralized platform. This gives bank employees and digital systems a complete view of each customer.

Why CRM Is So Important in the Banking Industry

Banks operate in a trust-based business. Customers share sensitive financial data and expect security, transparency, and reliability. Without the right tools, managing millions of customer relationships becomes inefficient and impersonal.

Modern CRM software for banks helps solve several key challenges:

- Managing customer data across multiple channels

- Delivering personalized services at scale

- Improving response time and service quality

- Identifying cross-selling and upselling opportunities

- Reducing customer churn

In short, CRM transforms banks from product-focused institutions into customer-centric organizations.

How Modern CRM Software Improves Customer Experience

Customer experience is no longer just about friendly service at the branch. It’s about consistency, speed, relevance, and convenience across every touchpoint. Let’s look at how modern banking CRM software improves each of these areas.

1. 360-Degree Customer View

One of the biggest advantages of CRM software for the banking industry is the ability to create a complete customer profile. This includes:

- Account and transaction history

- Loan and credit card usage

- Customer service interactions

- Digital behavior and preferences

With this unified view, bank staff can understand customer needs instantly and provide more relevant solutions without asking repetitive questions.

2. Personalized Banking Experiences

Modern customers expect banks to understand their financial goals. Banking CRM software uses data and analytics to personalize:

- Product recommendations

- Marketing messages

- Loan and credit offers

- Financial advice

For example, a CRM system can identify customers who frequently save money and suggest investment products that match their risk profile.

3. Faster and More Efficient Customer Support

CRM software for banks significantly improves customer support by giving service teams instant access to customer information. This reduces resolution time and increases first-contact resolution rates.

When a customer contacts the bank, agents can quickly see past issues, preferences, and ongoing requests, creating a smoother and less frustrating experience.

4. Seamless Omnichannel Communication

Today’s customers interact with banks through branches, call centers, mobile apps, email, and social media. CRM systems connect all these channels into one platform.

This ensures that conversations started on one channel can continue on another without losing context. Customers feel heard and valued, regardless of how they contact the bank.

Key Features of Banking CRM Software

Not all CRM systems are built for banking. CRM software for the banking industry includes specialized features designed to meet financial regulations and complex customer needs.

Customer Data Management

Secure storage and management of customer profiles, transaction records, and interaction history is the foundation of any banking CRM software.

Analytics and Reporting

Advanced analytics help banks identify trends, predict customer behavior, and measure customer satisfaction using data-driven marketing insights. These insights support smarter decision-making and proactive service.

Automation and Workflow Management

CRM systems automate routine tasks such as follow-ups, alerts, and approvals. This reduces manual work and ensures consistent service delivery.

Compliance and Security

Banks must comply with strict regulations. CRM software for banks includes built-in security, access controls, and audit trails to protect sensitive financial data.

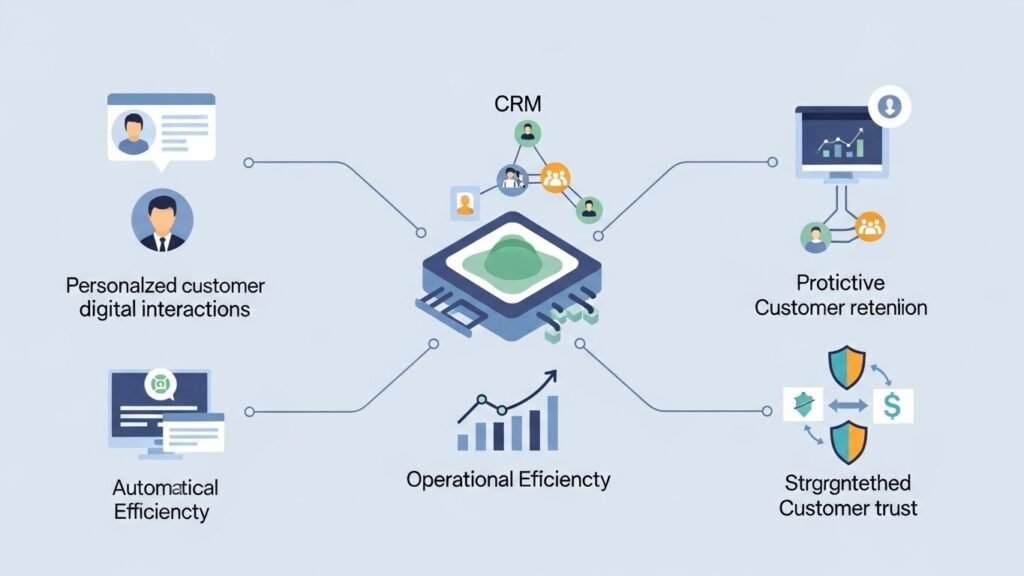

Benefits of CRM Software for Banks

Implementing a modern CRM system offers both short-term and long-term benefits for banks.

- Improved customer satisfaction through personalized and faster service

- Higher customer retention by addressing needs proactively

- Increased revenue from better cross-selling and upselling

- Operational efficiency through automation and better workflows

- Stronger customer trust through consistent and transparent interactions

Role of CRM in Digital Banking Transformation

As banks continue to move toward digital-first models, CRM becomes the backbone of customer engagement. CRM software integrates with mobile banking apps, AI chatbots, and data platforms to deliver intelligent and responsive experiences through modern digital customer engagement tools.

For digital-only banks and fintechs, CRM is essential for maintaining a human touch while operating at scale.

Challenges Banks Face When Implementing CRM

While the benefits are clear, implementing CRM software in the banking industry comes with challenges.

- Data migration from legacy systems

- Employee training and adoption

- Integration with existing banking platforms

- Ensuring data security and compliance

Successful banks approach CRM implementation as a long-term strategy rather than a one-time software installation, similar to building sustainable digital growth foundations.

Future of Customer Relationship Management in Banking

The future of customer relationship management in banking lies in AI-driven insights, predictive analytics, and hyper-personalization. CRM systems will increasingly anticipate customer needs before they arise.

As technology evolves, CRM software for banks will become more intelligent, helping financial institutions build deeper and more meaningful customer relationships.

Frequently Asked Questions

What is customer relationship management in banking?

Customer relationship management in banking is the use of strategies and CRM software to manage customer interactions, improve service quality, and build long-term relationships.

How does banking CRM software improve customer experience?

Banking CRM software improves customer experience by providing personalized services, faster support, seamless communication, and a unified view of customer data.

Is CRM software necessary for small banks?

Yes, CRM software for banks is valuable for institutions of all sizes. Small banks can use CRM to compete with larger players by delivering personalized and efficient service.

What makes CRM software for the banking industry different?

CRM software for the banking industry includes features like regulatory compliance, advanced security, financial data integration, and specialized analytics.

Can CRM software help banks increase revenue?

Yes, CRM systems help banks identify cross-selling opportunities, improve retention, and offer relevant products, all of which contribute to higher revenue.