Learning how to manage money wisely can feel overwhelming, especially if you’re just starting your financial journey. Exploring budgeting strategies for beginners can simplify your first steps.

An investing for beginners book can guide you step by step, showing practical strategies to grow your wealth and avoid common mistakes. Whether you want to save, invest, or simply understand how money works, these books are a valuable resource for anyone seeking financial confidence.

Why Reading an Investing Book for Beginners Matters

Many people think investing is only for experts or those with a lot of money, but according to Investopedia’s investing guide, beginners can start with simple strategies to grow wealth gradually.

However, the truth is that investing books for beginners are designed to simplify complex financial concepts. They help readers understand:

- How to budget effectively

- How to save and invest wisely

- How to avoid debt traps

- The principles behind long-term wealth growth

By learning these fundamentals early, you can make informed decisions and build a strong financial foundation.

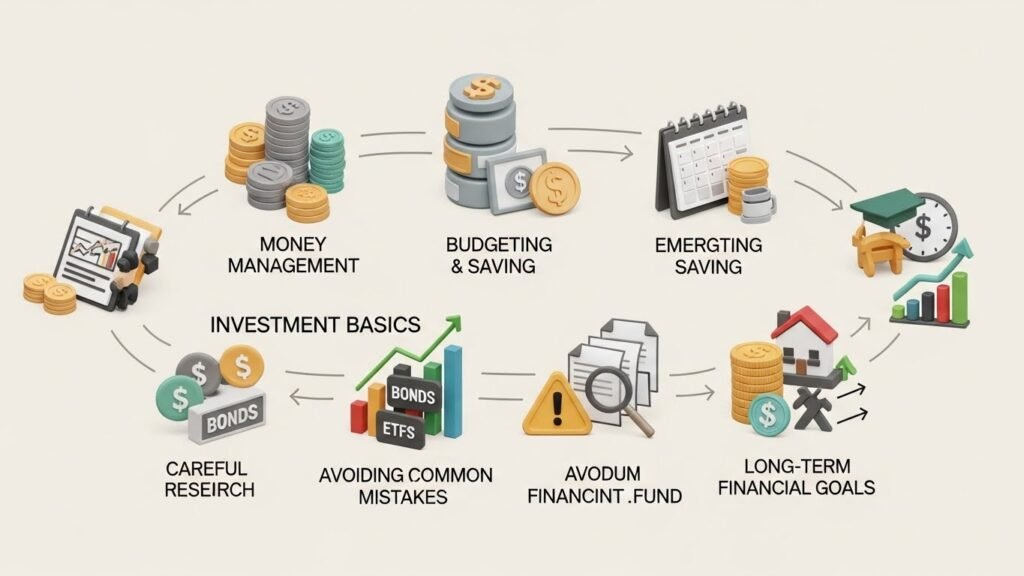

Key Lessons an Investing for Beginners Book Covers

1. Understanding Money and Its Value

An essential lesson in any investing for beginners book is the concept of money management, which aligns with practical money management tips for beginners.

You’ll learn how to track expenses, recognize unnecessary spending, and allocate funds toward investments. This knowledge creates the mindset necessary for financial discipline.

2. Budgeting and Saving Strategies

Budgeting is the cornerstone of money management. Beginner-friendly investing books often explain how to:

- Create a monthly budget

- Set aside emergency funds

- Prioritize spending to maximize savings

These skills ensure that you have the resources to invest consistently without compromising your lifestyle.

3. Basics of Investing

One of the most exciting parts of these books is learning about investment options. You’ll understand the differences between stocks, bonds, mutual funds, and ETFs, and how to choose the right mix based on your goals and risk tolerance. Our guide on investment strategies for beginners can help clarify these choices.

. Many beginner books include practical examples to show how small investments grow over time.

4. Avoiding Common Financial Mistakes

New investors often make mistakes like investing without research or relying on tips from unreliable sources. The best investing books for beginners PDF version typically highlights these pitfalls and teach how to avoid them, helping you save money and reduce stress.

5. Developing Long-Term Financial Goals

Beyond immediate budgeting and investing, these books teach you how to plan for the future. Setting realistic goals, whether for retirement, buying a home, or funding education, ensures your money works efficiently for you. This forward-thinking approach is what separates casual spenders from disciplined investors.

Choosing the Right Investing Book

Not all investing books are created equal. When selecting the best finance books for beginners, look for:

- Clear, simple explanations without jargon

- Step-by-step guides with actionable advice

- Real-world examples and case studies

- Up-to-date information on investment strategies

Some books even offer free PDFs for easy reading and reference, making it simpler to learn anytime, anywhere.

How to Make the Most of an Investing Book

Reading alone isn’t enough; applying what you learn is key. Here’s how to maximize your results:

- Take notes on concepts that resonate with you.

- Create a personal budget and track expenses.

- Start small with investments and gradually increase as confidence grows.

- Review progress regularly and adjust your strategies.

Consistency is more important than size. Even small, disciplined steps can lead to significant financial growth over time.

Conclusion

An investing for beginners book does more than just explain investment options—it teaches fundamental money management skills that last a lifetime. From budgeting and saving to smart investing and goal setting, these books empower readers to take control of their finances confidently. By choosing the right guide and applying its lessons, anyone can build a secure financial future.

FAQs About Investing for Beginners Books

What is the best investing book for beginners?

The best book depends on your learning style, but look for one that explains concepts clearly, offers practical advice, and includes examples. Many also provide a PDF version for easy reference.

Can I learn to invest without prior knowledge?

Absolutely. Beginner-friendly investing books break down complex topics, making them accessible for anyone regardless of experience.

Do investing books really help with money management?

Yes. They cover budgeting, saving, and avoiding common mistakes, giving you tools to manage money effectively while learning to invest.

Are PDF versions of investing books reliable?

Official PDFs from authors or publishers are reliable. Always ensure you access books from trustworthy sources to get accurate and updated content.