Learning the technical analysis of the financial markets can seem intimidating at first, but our guide on the best trading books for beginners makes it easier.

Charts, patterns, and indicators might look like a foreign language to beginners. But the right resources can make it simple and even enjoyable. If you’re looking to understand how traders predict market movements and make smarter investment decisions, finding the best book on technical analysis is the first step.

Why Technical Analysis Matters

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume, and you can learn more from this comprehensive guide on technical analysis.

Unlike fundamental analysis, which focuses on a company’s financials, technical analysis relies on charts and patterns to forecast market behavior. By mastering it, you can:

- Identify market trends early

- Understand price movements and momentum

- Spot profitable entry and exit points

- Make informed decisions without relying solely on news or opinions

For beginners, learning these concepts can seem overwhelming. That’s why choosing the best book on technical analysis is essential—it should simplify complex ideas and guide you step by step.

Top Recommendation: The Ultimate Book for Easy Learning

One book consistently recommended for beginners is “Technical Analysis of the Financial Markets” by John J. Murphy. This book is often considered the gold standard for anyone serious about learning technical analysis, yet it’s written in a way that’s accessible for beginners.

Key features that make it beginner-friendly:

- Clear explanations of technical indicators like moving averages, RSI, and MACD

- Step-by-step guidance on reading charts and spotting trends

- Illustrations that make complex concepts easy to understand

- Practical examples of real market scenarios

Whether you’re completely new to trading or just looking to strengthen your skills, this book serves as a comprehensive guide that grows with your knowledge.

Technical Analysis for Dummies: Simplified Learning

If you prefer a more casual, easy-to-follow approach, technical analysis for dummies books are also a great choice. They break down the topic into manageable sections, often using humor and relatable examples. While they may not be as in-depth as Murphy’s book, they help beginners grasp essential concepts without feeling overwhelmed.

Some key takeaways you’ll get from beginner-friendly guides include:

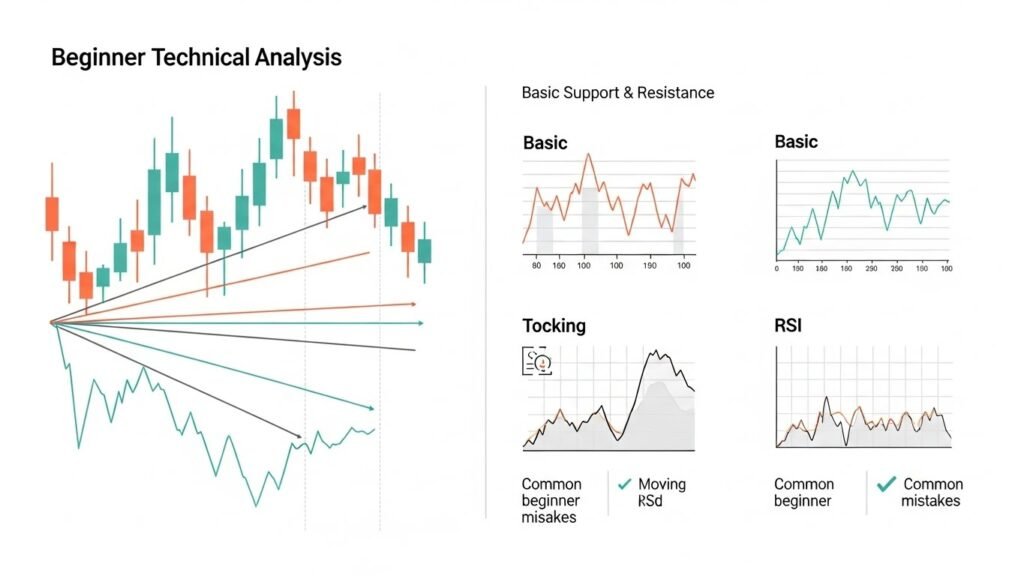

- Understanding candlestick patterns

- Basic support and resistance levels

- How to use technical indicators effectively

- Common mistakes to avoid when starting

Popular Technical Indicators to Know

Technical indicators are formulas or calculations based on price, volume, or open interest. They help traders make informed decisions. Here are a few you’ll likely encounter in most books:

- Moving Averages (MA): Helps smooth price data and identify trends

- Relative Strength Index (RSI): Measures the speed and change of price movements

- Moving Average Convergence Divergence (MACD): Shows the relationship between two moving averages

- Bollinger Bands: Indicates volatility and potential overbought or oversold conditions

Understanding these indicators is crucial. The best books on technical analysis provide clear explanations and practical examples, so you can start applying them to real charts immediately.

Choosing the Best Book on Technical Analysis

When selecting a book, consider your learning style and experience level, and check out our list of top investment books for additional insights.

Here’s a quick checklist:

- Does it explain technical indicators in simple terms?

- Are charts and diagrams clear and easy to follow?

- Does it include real-world examples?

- Is it beginner-friendly without skipping essential details?

- Does it cover both basic and advanced concepts over time?

Books that meet these criteria not only teach you the technical side of trading but also build confidence in your decision-making process.

Conclusion

Mastering the technical analysis of the financial markets doesn’t have to be intimidating. With the right resources—especially the best book on technical analysis—you can turn complex charts and indicators into actionable insights. Start with a comprehensive guide like John J. Murphy’s classic, supplement it with beginner-friendly “for dummies” style books, and practice regularly. With patience and study, technical analysis can become a powerful tool in your trading journey.

FAQ

What is the best book on technical analysis for beginners?

“Technical Analysis of the Financial Markets” by John J. Murphy is widely regarded as the best choice for beginners due to its clear explanations and practical examples.

What are the essential technical indicators to know?

Some essential indicators include Moving Averages, RSI, MACD, and Bollinger Bands. These tools help analyze market trends, momentum, and volatility.

Is technical analysis difficult to learn for beginners?

It can seem complex at first, but starting with beginner-friendly books and practicing with charts can make it manageable and understandable over time.

Can I rely solely on technical analysis for trading?

While technical analysis is a powerful tool, combining it with fundamental analysis and risk management strategies provides a more balanced approach.