This comprehensive guide walks you through everything you need to know about conducting effective market assessment analysis. You’ll discover why it matters, how to do it properly, what tools to use, and how to avoid common mistakes that undermine even well-intentioned research efforts.

- What Is Market Assessment Analysis and Why It Matters

- The Critical Role of Market Research Reports in Business Strategy

- 5 Essential Steps for Conducting Market Assessment Analysis

- Powerful Benefits of Thorough Market Assessment Analysis

- Critical Mistakes That Undermine Market Assessment Analysis

- Essential Tools for Conducting Market Assessment Analysis

- Integrating Market Assessment with Ongoing Marketing Analysis

- Frequently Asked Questions About Market Assessment Analysis

- Taking Action: Your Next Steps for Market Assessment Success

- Conclusion: Market Assessment as Competitive Advantage

By the end, you’ll understand exactly how to evaluate markets accurately and use those insights to build stronger strategies, allocate resources wisely, and position your business for sustainable growth in today’s competitive landscape.

What Is Market Assessment Analysis and Why It Matters

Market assessment analysis is the systematic process of evaluating a market’s potential, characteristics, dynamics, and viability for your business. It examines critical factors, including market size, growth trends, customer segments, competitive landscape, regulatory environment, and emerging opportunities or threats.

Think of market assessment analysis as creating a detailed map before embarking on a journey. Just as travelers study terrain, weather patterns, and potential obstacles before setting out, businesses must understand their market landscape before investing resources. This evaluation provides the foundation for virtually every strategic business decision, as explained in this authoritative Investopedia guide to market analysis.

The Core Components of Effective Market Assessment

Comprehensive market assessment analysis examines multiple interconnected elements:

- Market Size and Growth: Total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM), plus historical growth rates and future projections

- Customer Analysis: Demographics, psychographics, buying behaviors, pain points, preferences, and decision-making processes

- Competitive Landscape: Direct and indirect competitors, market share distribution, competitive advantages, and positioning strategies

- Industry Trends: Technological changes, regulatory developments, economic factors, and social shifts affecting the market

- Barriers and Opportunities: Entry barriers, growth constraints, untapped niches, and emerging market gaps

Each component contributes unique insights that together create a complete picture of market dynamics and business potential.

Why Accurate Market Analysis Is Non-Negotiable

The stakes for getting market analysis right are impossibly high. Consider these real-world consequences of inadequate market assessment:

- Resource Misallocation: Companies invest in products or markets with insufficient demand, wasting development costs and opportunity costs

- Strategic Missteps: Businesses enter oversaturated markets where profitability is impossible or miss emerging opportunities with high potential

- Marketing Failures: Campaigns target the wrong audiences with the wrong messages, burning through budgets without generating returns

- Competitive Disadvantage: Companies lose ground to better-informed competitors who understand market dynamics more clearly

- Missed Timing: Businesses enter markets too early (before demand materializes) or too late (after competition saturates)

Conversely, accurate market assessment analysis provides clarity that transforms business outcomes. Companies with deep market understanding consistently outperform competitors because they make smarter decisions about where to compete, how to position offerings, which customers to target, and when to pivot strategies.

The Critical Role of Market Research Reports in Business Strategy

Market research reports represent the tangible output of comprehensive market assessment analysis. These documents consolidate findings, data, insights, and recommendations into actionable intelligence that guides strategic decisions.

What Makes a Valuable Market Research Report

Effective market research reports go beyond presenting raw data. They provide context, interpretation, and strategic implications that non-technical stakeholders can understand and act upon. Quality reports include:

- Executive Summary: High-level overview of key findings, opportunities, and recommendations for quick decision-maker review

- Methodology Section: Transparent explanation of research approaches, data sources, and analytical methods used

- Market Overview: Size, segmentation, growth trends, and defining characteristics of the market landscape

- Competitive Analysis: Detailed profiles of key competitors, market share analysis, and competitive positioning maps

- Customer Insights: Detailed understanding of target audiences, their needs, preferences, and buying behaviors

- Trend Analysis: Emerging patterns, technological disruptions, regulatory changes, and market evolution forecasts

- Strategic Recommendations: Actionable insights tied directly to business objectives and market opportunities

How Market Research Reports Drive Decision-Making

Organizations use market research reports to validate or challenge assumptions across multiple business functions:

- Product Development: Identifying unmet needs and feature priorities based on customer feedback and competitive gaps

- Market Entry: Evaluating viability before committing resources to new geographic or demographic markets

- Investment Decisions: Providing due diligence data for acquisitions, partnerships, or internal capital allocation

- Marketing Strategy: Informing positioning, messaging, channel selection, and campaign development

- Sales Planning: Setting realistic targets, identifying high-potential segments, and optimizing territory assignments

The best market research reports don’t just sit on shelves—they actively shape strategy and get referenced repeatedly as living documents that guide ongoing decisions.

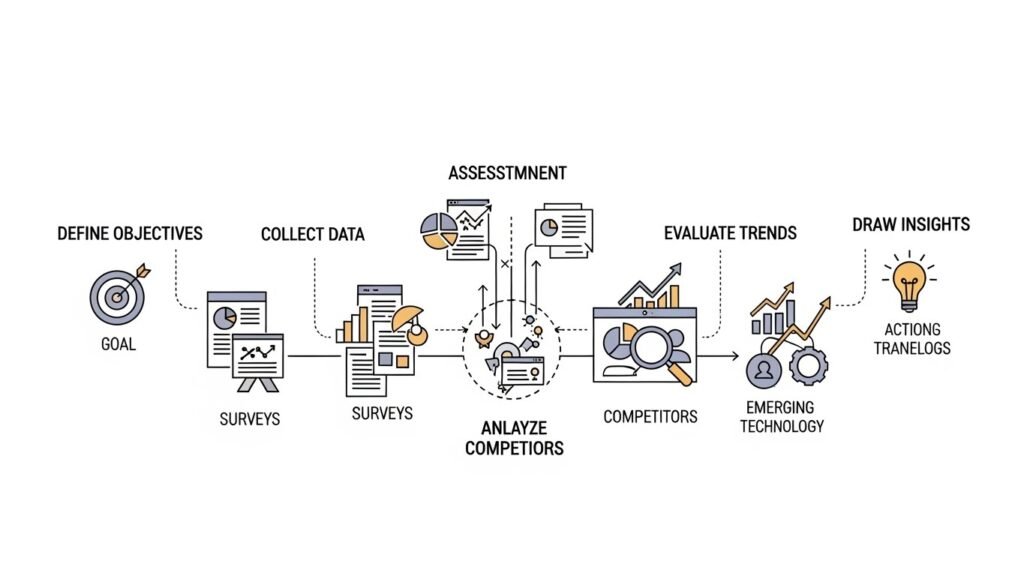

5 Essential Steps for Conducting Market Assessment Analysis

Performing thorough market assessment analysis requires a systematic methodology that ensures comprehensive coverage without overwhelming your team with unnecessary complexity.

Step 1: Define Crystal-Clear Assessment Objectives

Vague objectives produce vague results. Before collecting any data, establish specific goals for your market assessment analysis. Different objectives require different research approaches and data sources.

Common market assessment objectives include:

- Validating demand for a new product concept before development investment

- Evaluating expansion into new geographic markets or customer segments

- Understanding why sales have plateaued or declined in existing markets

- Identifying acquisition targets or partnership opportunities

- Benchmarking performance against competitors and industry standards

- Forecasting market evolution to inform long-term strategic planning

Document your objectives in writing and ensure stakeholders agree on priorities. This alignment prevents scope creep and keeps research focused on questions that actually matter for upcoming decisions.

For product-specific assessments, consider conducting a thorough product-market fit analysis to validate demand before full development.

Step 2: Collect Comprehensive, Multi-Source Data

Data quality determines assessment accuracy. Robust market assessment analysis combines primary research (original data you collect) with secondary research (existing published data) for comprehensive coverage.

Primary Research Methods

Primary research provides current, specific insights tailored to your exact questions:

- Customer Surveys: Quantitative data on preferences, satisfaction, buying behaviors, and demographic characteristics

- In-Depth Interviews: Qualitative insights into motivations, pain points, decision processes, and unmet needs

- Focus Groups: Interactive discussions revealing how customers think about problems and evaluate solutions

- Observational Research: Watching how customers actually behave versus what they say they do

- Pilot Programs: Small-scale tests providing real-world validation of assumptions and concepts

Secondary Research Sources

Secondary research leverages existing knowledge to provide context and benchmarks:

- Industry Reports: Published market studies from firms like IBISWorld, Gartner, or Forrester

- Government Data: Census information, economic statistics, regulatory filings, and trade data

- Trade Publications: Industry journals, magazines, and news sources covering market developments

- Academic Research: Scholarly studies on consumer behavior, market dynamics, and industry trends

- Company Information: Competitor websites, annual reports, press releases, and public financial filings

- Online Analytics: Search trends, social media discussions, review platforms, and web traffic data

The most reliable market assessments triangulate findings across multiple sources. If customer interviews, industry reports, and sales data all point to the same conclusion, confidence in that insight increases substantially.

Step 3: Conduct Deep Competitive Analysis

Understanding competitors is essential for positioning your business effectively and identifying competitive advantages. Comprehensive competitive analysis examines both direct competitors (offering similar solutions to the same customers) and indirect competitors (solving the same customer problems differently).

Key Areas for Competitive Evaluation

Analyze competitors across multiple dimensions:

- Market Position: Current market share, growth trajectory, and strategic focus areas

- Product Offerings: Features, quality, pricing, and how they address customer needs

- Business Model: Revenue streams, cost structure, and value delivery mechanisms

- Marketing Approach: Positioning, messaging, channels, and campaign strategies

- Customer Base: Who they serve, loyalty levels, and satisfaction ratings

- Strengths and Weaknesses: What they do exceptionally well and where vulnerabilities exist

- Strategic Direction: Where they’re investing and how they’re evolving

Applying proven competitor analysis techniques ensures you identify both obvious and subtle competitive dynamics that affect your market position.

Competitive Intelligence Gathering Methods

Ethical competitive intelligence relies on publicly available information:

- Analyzing competitor websites, blogs, and content marketing

- Monitoring social media presence and engagement patterns

- Reading customer reviews on third-party platforms

- Attending industry conferences and trade shows

- Studying job postings for insights into strategic priorities

- Reviewing financial reports and investor presentations

- Using competitive analysis tools like SEMrush, SimilarWeb, or SpyFu

Step 4: Evaluate Market Trends and Future Trajectory

Markets constantly evolve. Yesterday’s winning strategy becomes tomorrow’s outdated approach. Effective market assessment analysis doesn’t just photograph the current state—it projects where markets are heading.

Critical Trend Categories to Monitor

- Technological Trends: Emerging technologies disrupting existing solutions or creating new possibilities

- Demographic Shifts: Population changes affecting customer bases, preferences, and buying power

- Economic Factors: Growth rates, employment levels, consumer confidence, and spending patterns

- Regulatory Changes: New laws, compliance requirements, or policy shifts affecting market dynamics

- Social Movements: Changing values, preferences, and behaviors are reshaping demand

- Competitive Evolution: How competitor strategies and market structure are changing

- Supply Chain Dynamics: Shifts in production, distribution, or sourcing affecting market economics

Forecasting Future Market Conditions

While predicting the future remains imperfect, several methods improve forecast accuracy:

- Trend Extrapolation: Projecting historical patterns forward with adjustments for known changes

- Scenario Planning: Developing multiple possible futures based on different assumption sets

- Expert Consultation: Gathering insights from industry thought leaders and subject matter experts

- Leading Indicators: Identifying early signals that predict larger market movements

- Analogous Markets: Studying similar markets that evolved earlier for pattern insights

Step 5: Transform Data Into Strategic Insights

Data without interpretation provides limited value. The final and most critical step involves synthesizing findings into clear, actionable insights that directly inform business decisions.

From Information to Intelligence

Effective analysis answers strategic questions:

- Market Opportunity: Is there sufficient demand to justify investment? How large is the realistic opportunity?

- Competitive Positioning: Where can we differentiate? What unique value can we deliver?

- Target Customers: Which segments offer the best fit for our capabilities and highest potential returns?

- Market Timing: Is now the right time to enter or expand, or should we wait for better conditions?

- Resource Requirements: What investment is needed to compete effectively in this market?

- Success Probability: Given all factors, what are realistic expectations for outcomes?

- Risk Mitigation: What threats exist, and how can we address or minimize them?

Strong market assessment analysis connects findings directly to recommendations. Don’t just report that “the market is growing at 15% annually”—explain what that growth means for your specific business opportunity and what actions it suggests.

Incorporating insights from comprehensive marketing data analysis ensures your strategic recommendations align with actual customer behavior and campaign performance data.

Powerful Benefits of Thorough Market Assessment Analysis

Investing time and resources into a comprehensive market assessment delivers returns that compound across your entire organization. Let’s examine the specific advantages businesses gain from rigorous market analysis.

Dramatically Improved Decision-Making Quality

Data-driven decisions consistently outperform gut-feel judgments. Market assessment analysis replaces assumptions with evidence, reducing uncertainty and improving outcomes across strategic choices.

Businesses with strong market intelligence:

- Enter markets with realistic expectations rather than optimistic fantasies

- Develop products that customers actually want instead of solutions seeking problems

- Price offerings are competitively based on value perception and market benchmarks

- Allocate resources to high-potential opportunities rather than long-shot gambles

- Pivot quickly when data indicates strategy adjustments are needed

Optimized Resource Allocation and ROI

Every business operates with limited resources—time, money, people, and attention. Market assessment analysis ensures these precious resources flow toward opportunities offering the highest returns.

Instead of spreading efforts thinly across multiple possibilities, assessed markets reveal where to concentrate for maximum impact. This focus amplifies results while reducing waste on low-potential initiatives.

Sustainable Competitive Advantages

Understanding your market more deeply than competitors creates lasting advantages. When you know customer needs, competitive weaknesses, and emerging trends better than rivals, you can:

- Differentiate offerings in ways that genuinely matter to customers

- Identify and exploit market gaps before competitors recognize them

- Anticipate competitive moves and prepare counter-strategies

- Build customer relationships based on a superior understanding of their needs

- Adapt faster to market changes because you monitor trends systematically

Enhanced Marketing Effectiveness and Efficiency

Marketing analysis grounded in solid market assessment produces dramatically better results. When you understand customer segments, preferences, pain points, and decision processes, marketing becomes strategic rather than experimental.

Benefits include:

- Precise Targeting: Focusing campaigns on segments most likely to convert

- Compelling Messaging: Addressing actual customer concerns rather than assumed problems

- Optimal Channel Selection: Investing in channels where target customers actually spend time

- Better Conversion Rates: Aligning offers with demonstrated customer preferences

- Improved ROI: Eliminating waste on ineffective approaches identified through testing

Risk Reduction and Future-Proofing

Markets contain both opportunities and threats. Comprehensive assessment identifies potential risks before they become crises:

- Regulatory changes that could disrupt business models

- Technological shifts are making current approaches obsolete

- Emerging competitors with disruptive business models

- Changing customer preferences, reducing demand for current offerings

- Economic conditions affecting customer buying power or priorities

Early identification enables proactive response rather than reactive crisis management. Companies that monitor markets continuously adapt gradually rather than facing sudden existential threats.

Organizational Alignment and Clarity

Shared market understanding creates alignment across departments. When everyone operates from the same market insights, collaboration improves, and conflicting priorities decrease.

Sales, marketing, product development, and customer service all benefit from a consistent understanding of who customers are, what they need, how competitors position themselves, and where markets are heading.

Critical Mistakes That Undermine Market Assessment Analysis

Even experienced professionals make errors that compromise market assessment quality. Awareness of common pitfalls helps you avoid them in your own research.

Over-Reliance on Secondary Data Without Validation

Published market reports and industry statistics provide valuable context, but they can’t replace primary research tailored to your specific questions. Secondary data often lacks the nuance, timeliness, or specificity you need for confident decisions.

Generic industry reports might indicate overall market growth while missing critical segment-level dynamics that affect your particular opportunity. Always validate secondary findings through primary research that tests assumptions with real customers in your specific market context.

Ignoring Contradictory Evidence and Confirmation Bias

Humans naturally seek information confirming existing beliefs while dismissing contradictory data. In market assessment, confirmation bias leads to overly optimistic projections and missed warning signs.

Combat this tendency by:

- Actively seeking disconfirming evidence for your assumptions

- Inviting devil’s advocate perspectives during analysis

- Including team members without emotional investment in particular outcomes

- Conducting pre-mortems, imagining why initiatives might fail

- Testing hypotheses with real market experiments rather than just research

Focusing Exclusively on Competitors While Ignoring Broader Trends

Competitive analysis matters, but obsessing over current competitors while missing larger market forces creates blind spots. The most disruptive threats often come from outside traditional competitive sets.

Consider how:

- Uber disrupted taxis despite not being a traditional transportation company

- Netflix destroyed Blockbuster by changing content delivery models entirely

- Smartphones made standalone cameras, GPS devices, and music players obsolete

A comprehensive market assessment examines competitive dynamics within the context of broader technological, social, and economic trends that could reshape entire categories.

Conducting One-Time Assessments Without Regular Updates

Markets don’t stand still. A perfectly accurate assessment today becomes outdated tomorrow as conditions change. Treating market assessment as a one-time project rather than an ongoing process creates a strategy based on stale information.

Establish regular review cycles:

- Annual comprehensive reassessments for relatively stable markets

- Quarterly updates for fast-moving industries

- Immediate reviews when significant events occur (new regulations, major competitor moves, technological breakthroughs)

- Continuous monitoring of key metrics and trend indicators

Gathering Data Without a Clear Strategic Application

Research for research’s sake wastes resources. Every data point collected should connect to specific strategic questions or decisions. Before gathering information, ask: “How will this data influence our decisions? What will we do differently based on the answer?”

If you can’t articulate how information will affect strategy, don’t waste time collecting it. Focus assessment efforts on insights that genuinely drive better decisions rather than creating impressive but ultimately unused reports.

Underestimating Implementation Challenges

Market opportunity means little without a realistic assessment of what’s required to capture it. Many market assessments identify attractive opportunities while glossing over barriers to entry, resource requirements, or organizational capabilities needed for success.

Honest assessment acknowledges:

- Capital requirements and funding availability

- Time needed to build necessary capabilities

- Organizational change is required to execute the strategy

- Competitive responses that will emerge

- Execution risks beyond market characteristics

Essential Tools for Conducting Market Assessment Analysis

The right tools streamline market assessment while improving data quality and analytical rigor. Here’s a comprehensive toolkit for different assessment aspects.

Customer Research and Survey Tools

- SurveyMonkey: User-friendly survey creation with templates and basic analysis

- Typeform: Engaging, conversational surveys with higher completion rates

- Qualtrics: Enterprise-grade research platform with advanced analytics

- Google Forms: Free, simple surveys integrated with Google Workspace

- UserTesting: Video feedback from real users interacting with products or websites

Competitive Intelligence Platforms

- SEMrush: Comprehensive SEO, advertising, and content competitive analysis

- Ahrefs: Backlink analysis and organic search competitive intelligence

- SimilarWeb: Website traffic estimation and digital strategy insights

- SpyFu: Competitor keyword and advertising budget analysis

- Crayon: Automated competitive intelligence monitoring and alerts

Market Data and Industry Research Sources

- IBISWorld: Detailed industry reports with market size, trends, and forecasts

- Statista: Statistical data across industries and markets globally

- Gartner: Technology market research and advisory services

- Forrester: Consumer and business technology research

- Euromonitor: Consumer markets intelligence and strategic analysis

- Grand View Research: Industry analysis and market research reports

Trend Analysis and Monitoring Tools

- Google Trends: Search interest patterns over time and geography

- Exploding Topics: Emerging trend identification before mainstream awareness

- BuzzSumo: Content performance and social media trend analysis

- Feedly: RSS feed aggregation for industry news monitoring

- Mention: Brand and topic monitoring across the web and social media

Customer Relationship and Analytics Platforms

- Salesforce: CRM with sales data and customer insights

- HubSpot: Marketing, sales, and service platform with analytics

- Google Analytics: Website traffic and user behavior analysis

- Mixpanel: Product analytics and user journey tracking

- Amplitude: Behavioral analytics for digital products

Social Listening and Community Intelligence

- Hootsuite: Social media management with listening capabilities

- Sprout Social: Social engagement and analytics platform

- Brandwatch: Enterprise social listening and consumer intelligence

- Reddit: Community discussions revealing authentic customer perspectives

- Quora: Question platforms showing what people actually ask about topics

Integrating Market Assessment with Ongoing Marketing Analysis

The most powerful approach combines strategic market assessment with tactical marketing analysis in a continuous feedback loop. This integration ensures strategies remain grounded in market reality while execution data refines market understanding.

Creating a Market Intelligence System

Rather than treating market assessment as occasional projects, build ongoing intelligence systems that continuously gather, analyze, and disseminate market insights across your organization.

Key components include:

- Regular Data Collection: Automated tools capturing competitive activity, customer feedback, and market trends

- Centralized Repository: Single source of truth for market insights accessible to relevant stakeholders

- Scheduled Review Cadence: Regular meetings to discuss findings and strategic implications

- Cross-Functional Participation: Sales, marketing, product, and leadership contributing perspectives

- Action Orientation: Clear processes for translating insights into strategic adjustments

Connecting Strategic Assessment to Tactical Execution

Market assessment informs which strategies to pursue. Marketing analysis evaluates how well those strategies perform. Together, they create a learning cycle:

- Assessment identifies opportunities based on market gaps, customer needs, and competitive weaknesses

- Strategy defines approaches for capturing identified opportunities

- Tactics execute strategy through specific campaigns, products, and initiatives

- Analysis measures results from tactical execution against strategic goals

- Insights refine understanding of market dynamics based on real-world performance

- Assessment updates incorporate new learnings, completing the cycle

This integration prevents strategies from becoming disconnected from execution reality while ensuring tactical activities serve strategic objectives rather than operating independently.

Using Performance Data to Validate Market Assumptions

Market assessment involves assumptions about customer preferences, competitive dynamics, and market potential. Marketing execution provides real-world data to test these assumptions.

For example:

- If the assessment suggests customers prioritize price over features, but premium products outperform budget options, reassess that assumption

- If competitive analysis identifies specific rivals as primary threats, but customers actually compare your offerings to different alternatives, update the competitive understanding

- If market sizing suggests strong demand in particular segments, but conversion rates disappoint, investigate whether sizing was accurate or execution needs improvement

The best market assessment acknowledges uncertainty and builds in mechanisms for continuous validation and refinement based on emerging evidence.

Frequently Asked Questions About Market Assessment Analysis

What is the difference between market assessment analysis and market research?

Market assessment analysis evaluates the overall market environment, trends, competition, and potential opportunities comprehensively. Market research focuses on gathering specific data about particular aspects like customer preferences, buying behavior, or competitor pricing. Think of market assessment as the big picture strategy and market research as tactical data collection. Both work together for complete market analysis—research provides data that the assessment interprets within a broader strategic context.

How often should a market assessment analysis be updated?

Update your market assessment at least annually for stable industries, or quarterly for fast-moving sectors like technology or fashion. Additionally, conduct immediate reassessments when significant changes occur: new major competitors entering the market, regulatory changes, technological disruptions, economic shifts, or changes in consumer behavior patterns. Regular updates ensure your strategies remain relevant and effective. Some companies maintain continuous monitoring systems with formal reassessments at scheduled intervals, while others update opportunistically when contemplating major decisions.

Can small businesses benefit from market assessment analysis?

Absolutely. Small businesses often benefit even more from market assessment analysis because they have limited resources and can’t afford costly mistakes. A proper assessment helps small businesses identify niche opportunities, understand local competition, allocate marketing budgets effectively, and avoid entering oversaturated markets. Even simplified assessments using free tools and basic research methods provide valuable insights that improve decision-making and reduce risk. The key is scaling assessment depth to match business size and resource availability while maintaining methodological rigor.

What tools help in conducting market assessment analysis?

Effective tools include Google Trends for search behavior analysis, SurveyMonkey or Typeform for customer surveys, SEMrush or Ahrefs for competitive analysis, industry reports from IBISWorld or Statista, CRM analytics from Salesforce or HubSpot, social listening tools like Hootsuite or Sprout Social, and government databases for demographic data. Combining multiple tools provides comprehensive market insights. Start with free or low-cost options and invest in premium tools as your assessment needs become more sophisticated and budgets allow.

Is market assessment analysis the same as marketing analysis?

No, they serve different purposes. Market assessment analysis examines the entire market landscape—size, trends, competitors, customer segments, and opportunities. Marketing analysis evaluates the performance of your specific marketing activities—campaign ROI, channel effectiveness, messaging impact, and conversion rates. Market assessment informs what strategies to pursue, while marketing analysis measures how well those strategies perform. The most effective approach integrates both: use market assessment to set direction, then use marketing analysis to optimize execution and validate assumptions.

How much does a professional market assessment analysis cost?

Costs vary widely based on scope and depth. DIY assessments using free tools cost only time investment. Basic professional reports from market research firms range from $1,000-$5,000. Comprehensive custom market assessments for specific industries or regions can cost $10,000-$50,000 or more. Ongoing market intelligence subscriptions from major firms range from several thousand to hundreds of thousands annually. Many businesses start with affordable secondary research and invest in primary research for critical decisions where the stakes justify the investment.

What is the most important component of market assessment analysis?

Understanding your target customer is arguably most important. You can have perfect data on market size and competitors, but without deep customer insights—their needs, pain points, buying behaviors, and preferences—your strategies will miss the mark. Customer-centric market assessment ensures all other components (competitor analysis, trend evaluation, opportunity identification) align with actual market demand. Markets exist because customers have needs; understanding those needs deeply creates the foundation for everything else in your assessment and strategy.

Can I conduct market assessment analysis without hiring experts?

Yes, especially for small to medium projects. Numerous free and affordable resources exist: government statistical databases, industry association reports, Google Trends, free survey tools, competitor website analysis, and customer interviews. While professional analysts bring expertise and objectivity, motivated business owners can conduct valuable assessments using available tools and methodical approaches. Start simple and expand as needs grow. The key is maintaining analytical rigor, avoiding bias, and being honest about the limitations of self-conducted research versus professional studies.

How do I know if my market assessment analysis is accurate?

Validate accuracy by cross-referencing multiple data sources, testing assumptions with small pilot programs, comparing findings with industry benchmarks, seeking feedback from industry experts or advisors, and monitoring whether predictions align with actual market behavior over time. Accurate assessments should provide insights that lead to successful strategic decisions and measurable business improvements. If strategies based on your assessment consistently underperform or surprise you, reassess methodology and assumptions. Build in mechanisms for continuous validation rather than assuming one-time assessments remain accurate indefinitely.

What’s the biggest mistake businesses make in market assessment?

The most common mistake is confirmation bias—seeking data that supports pre-existing beliefs while ignoring contradictory evidence. Businesses often overestimate market size, underestimate competition, or dismiss customer feedback that challenges their product vision. This leads to overly optimistic projections and poor strategic decisions. Objective, unbiased analysis that honestly evaluates both opportunities and threats produces the most valuable and actionable market assessments. Combat bias by actively seeking disconfirming evidence, involving skeptical perspectives, and testing assumptions with real market experiments.

Taking Action: Your Next Steps for Market Assessment Success

Understanding the market assessment analysis conceptually provides limited value without implementation. Transform knowledge into results by taking these concrete next steps.

Start With What You Can Control Today

You don’t need massive budgets or extensive teams to begin improving market understanding. Start with accessible actions:

- Define Your Most Critical Questions: What market uncertainties most affect upcoming decisions? Write them down explicitly.

- Gather Available Data: What information already exists within your organization—sales data, customer feedback, competitive observations? Consolidate it.

- Conduct Customer Conversations: Talk to 10-20 customers or prospects about their needs, challenges, and decision processes. Listen more than you talk.

- Analyze Top Competitors: Deep dive into 3-5 key competitors using public information—websites, reviews, social media, job postings.

- Document Findings: Create a simple report capturing insights, even if informal. Writing clarifies thinking.

Build Market Intelligence Capabilities Over Time

Market assessment excellence develops gradually. Establish foundations now and enhance sophistication as capabilities grow:

- Quarter 1: Conduct initial baseline assessment using available resources

- Quarter 2: Implement basic monitoring systems for competitors and trends

- Quarter 3: Add customer research capabilities through surveys or interviews

- Quarter 4: Formalize review processes and expand data sources

- Year 2: Integrate advanced tools and potentially professional research support

Make Market Assessment Part of Your Strategic DNA

The most successful companies don’t view market assessment as occasional projects but as continuous organizational capabilities. Embed market intelligence into how your business operates:

- Include market insights in regular leadership meetings

- Make customer understanding a hiring priority across roles

- Celebrate when market intelligence drives better decisions

- Invest in tools and training that improve analytical capabilities

- Create feedback loops connecting strategy, execution, and learning

Conclusion: Market Assessment as Competitive Advantage

Market assessment analysis isn’t optional administrative work—it’s the foundation for every strategic advantage your business can build. Companies that understand their markets deeply make smarter decisions about where to compete, how to differentiate, which customers to target, and when to pivot.

The difference between businesses that thrive and those that struggle often comes down to information quality. Do you truly understand your customers’ evolving needs? Do you accurately assess competitive dynamics? Can you identify emerging opportunities before they become obvious to everyone?

Market assessment analysis provides this critical intelligence. It transforms uncertainty into clarity, validates assumptions with data, and reveals opportunities invisible to less informed competitors. From crafting precise marketing campaigns to making informed investment decisions, accurate market analysis ensures you stay ahead of trends, competitors, and customer expectations.

The market rewards businesses that invest time and resources into understanding it thoroughly. Start building your market intelligence capabilities today. Define your critical questions, gather available data, talk to customers, analyze competitors, and document insights systematically.

Your future success depends not on perfect predictions but on superior understanding. Market assessment analysis provides that understanding—giving you the clarity and confidence needed to navigate complexity, capitalize on opportunities, and build sustainable competitive advantages in today’s dynamic business environment.

The companies dominating your industry tomorrow are the ones investing in market understanding today. Make market assessment analysis a core capability, and watch how better information transforms every aspect of your business strategy and execution.